ReAct Modular Agent: Orchestrating Tool-Use and Retrieval for Financial Workflows

DOI:

https://doi.org/10.58190/icisna.2025.138Keywords:

Agentic AI, Retrieval-Augmented Generation (RAG), Chain-of-Thought (CoT), Reasoning and Action (ReAct), Financial Advisory, LLMsAbstract

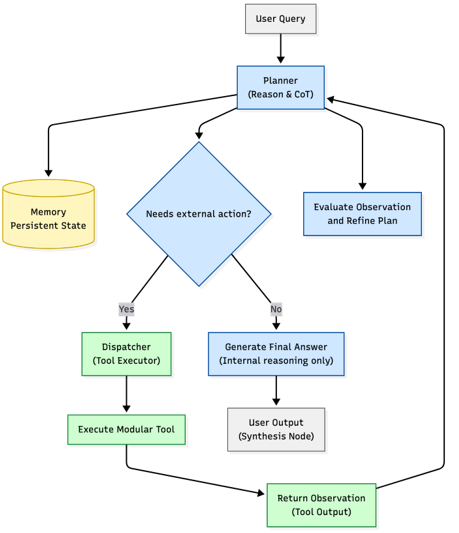

The financial advisory profession demands extreme precision and speed in decision-making, compounded by the complexity of modern capital markets software. This often leads to high training overhead and reduces the time financial advisors can dedicate to client relations. This paper introduces an Agentic AI Co-Pilot designed as a significant architectural advancement beyond traditional Retrieval-Augmented Generation (RAG) systems. The core framework leverages a specialized Enterprise AI Flow to orchestrate a modular, decoupled agent architecture.

The system's central component, the Reasoning and Action Agent (RAA), which implements the ReAct (Reasoning and Acting) paradigm that executes a fusion of explicit reasoning and external tool-use. This modularity allows the agent to: (1) interpret complex natural language queries, (2) articulate an internal step-by-step plan via Chain-of-Thought (CoT), and (3) autonomously execute a sequence of decoupled, modular API tools to perform high-stakes operations. This architectural separation ensures the seamless and incremental expansion of capabilities (e.g., integrating a risk-check API or a financial market forecasting module) without the need for retraining the core reasoning model. By providing both traceability and automated execution across complex workflows, the solution aims to substantially improve operational efficiency, enhance compliance through traceable decisions, and elevate the user experience in the highly regulated financial ecosystem.