An Intelligent Multi-Algorithm Integration Framework for Automated M&A Decision Support in Technology-Intensive Industries

DOI:

https://doi.org/10.58190/icisna.2025.133Keywords:

Survival Analysis, Cox Proportional Hazards, Mergers and Acquisitions, Technology Disruption, EDA Industry, Kaplan-Meier Curves, Concordance IndexAbstract

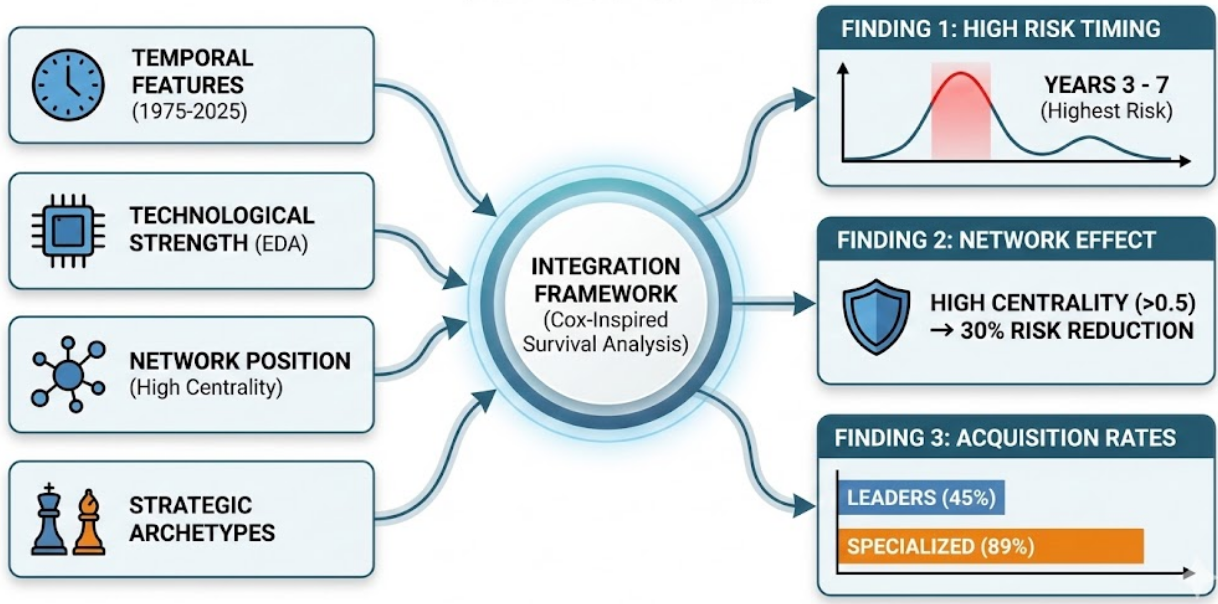

The time-based patterns of technology-driven mergers and acquisitions exceed what standard binary classification systems can identify. The research focuses on predicting acquisition timing for companies during times of technological change instead of simply determining acquisition status. The research uses survival analysis through Cox-inspired risk scoring framework to analyze 661 M&A deals in Electronic Design Automation (EDA) from 1975 to 2025. The research combines four analytical approaches which include temporal features and technological strength and network position and strategic archetypes. The research uses historical acquisition data from 2015 to 2020 to validate the model through calculated concordance index and Brier score and time-dependent AUC metrics. The research findings show that companies face their highest acquisition risk during their third to seventh year of operation. The research shows that companies with high network centrality (degree > 0.5) experience a 30% reduction in acquisition risk. The research shows that acquisition rates between companies vary from 45% for established technology leaders to 89% for specialized businesses. The model generates survival probability estimates and explains which factors influence the results to fill a major knowledge gap in corporate finance research.